Thomas Insurance Advisors Can Be Fun For Anyone

Wiki Article

The smart Trick of Thomas Insurance Advisors That Nobody is Talking About

Table of ContentsThe Best Guide To Thomas Insurance AdvisorsThe Ultimate Guide To Thomas Insurance AdvisorsThe smart Trick of Thomas Insurance Advisors That Nobody is Talking AboutSome Known Details About Thomas Insurance Advisors What Does Thomas Insurance Advisors Do?

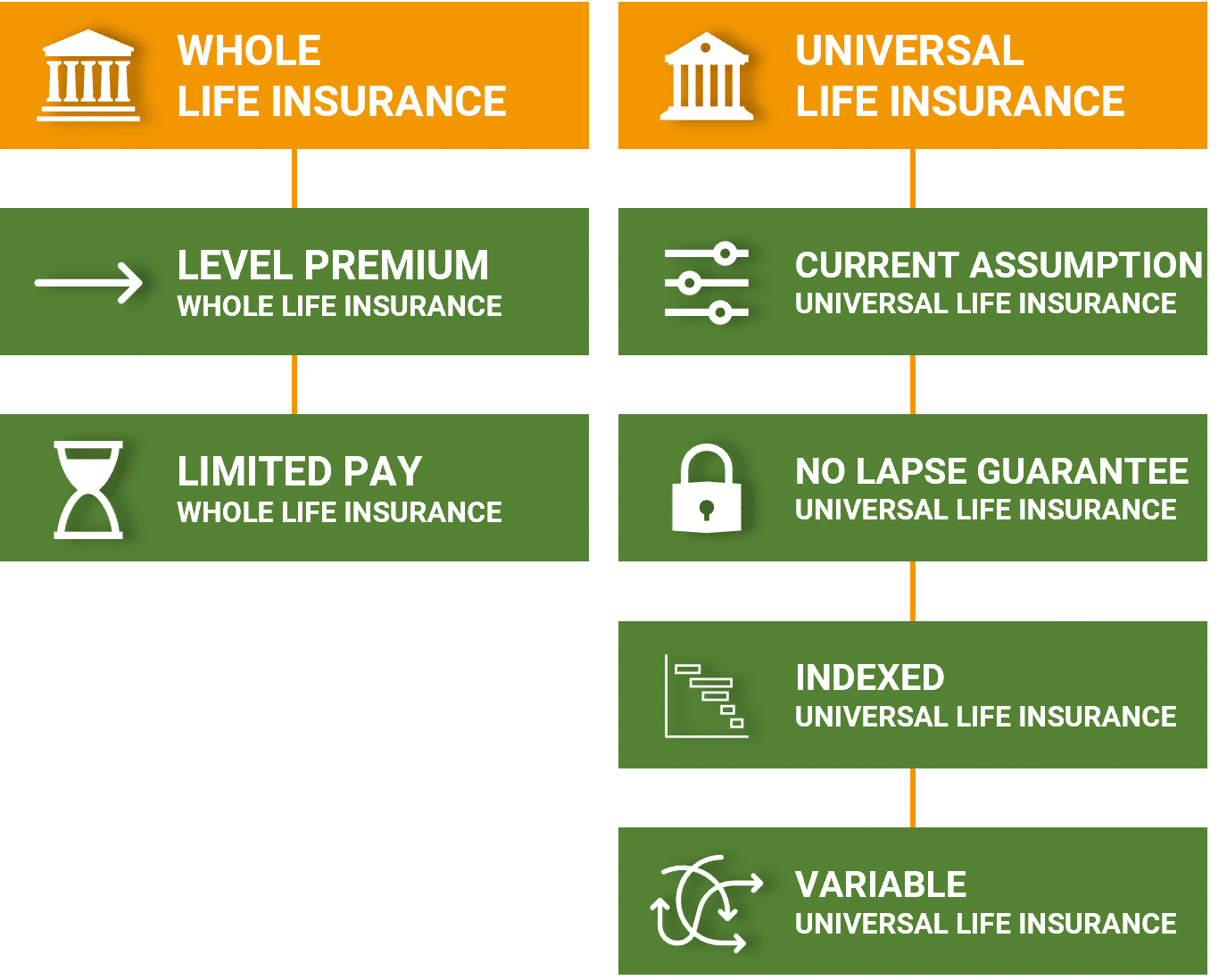

The cash money value component makes entire life a lot more intricate than term life because of fees, taxes, passion, and also various other terms. Universal life insurance policy is an adaptable irreversible life insurance coverage plan that allows you reduce or boost just how much you pay towards your month-to-month or yearly costs over time. If you decrease just how much you invest on costs, the difference is taken out from your plan's cash money worth.A global plan can be much more pricey and also difficult than a typical whole life policy, particularly as you age and your premiums enhance (https://www.producthunt.com/@jstinsurance1). Best for: High income earners that are trying to develop a nest egg without going into a higher revenue bracket. Exactly how it functions: Universal life insurance enables you to readjust your costs and survivor benefit depending on your requirements.

The Basic Principles Of Thomas Insurance Advisors

Pro: Gains possible variable plans might make more interest than standard whole life. Con: Investment risk possibility for losing money if the funds you picked underperform. Last expenditure insurance coverage, additionally understood as interment insurance, is a type of life insurance policy designed to pay a tiny survivor benefit to your family to aid cover end-of-life costs.

As a result of its high rates as well as reduced coverage quantities, last expenditure insurance coverage is usually not as excellent a value as term life insurance policy. Best for: People who have trouble getting approved for conventional coverage, like seniors and also individuals with severe health problems. How it functions: Unlike many standard policies that call for a medical examination, you just need to respond to a couple of questions to get last expense insurance coverage.

5 Easy Facts About Thomas Insurance Advisors Described

Pro: Guaranteed protection simple access to a small advantage to cover end-of-life expenses, consisting of clinical expenses, interment or cremation services, as well as coffins or urns. Con: Expense expensive premiums for reduced protection amounts. The very best way to pick the policy that's finest for you is to talk with a financial expert and also job with an independent broker to discover the best policy for your specific needs.Term life insurance plans are generally the very best service for people that require budget-friendly life insurance policy for a specific duration in their life (https://zenwriting.net/jstinsurance1/thomas-insurance-advisors-your-trusted-insurance-partner-in-toccoa-ga). If your objective is to give a security internet for your family if they needed to live without your income or payments to the family, term life is likely a great suitable for you.

If you're currently making the most of contributions to conventional tax-advantaged accounts like a 401(k) and also Roth Individual retirement account and also desire an additional financial investment lorry, permanent life insurance coverage could work for you. Last cost insurance policy can be an alternative for individuals that may not be able to get insured otherwise because of age or major health conditions, or elderly consumers who do not desire to burden their family members with burial prices.

Thomas Insurance Advisors - The Facts

Much of these life insurance choices are subtypes of those featured over, implied to serve a certain purpose, or they are specified by how their application procedure likewise called underwriting works - https://www.domestika.org/en/jstinsurance1. By kind of protection, By kind of underwriting Team life insurance policy, also called group term life insurance coverage, is one life insurance policy contract that covers a team of people.Team term life insurance policy is usually subsidized by the insurance policy holder (e. g., your company), so you pay little or none of the plan's costs. You obtain why not look here coverage as much as a restriction, generally $50,000 or one to two times your annual income. Team life insurance is budget-friendly as well as very easy to get, but it rarely offers the degree of insurance coverage you could require and also you'll possibly shed insurance coverage if you leave your work.

Best for: Any person that's provided group life insurance policy by their employer. Pro: Convenience group policies offer guaranteed protection at little or no expense to workers. Con: Limited insurance coverage as well as you usually shed insurance coverage if you leave your employer. Home mortgage protection insurance policy, additionally called MPI, is designed to settle your remaining home mortgage when you die.

4 Easy Facts About Thomas Insurance Advisors Shown

With an MPI policy, the recipient is the mortgage firm or loan provider, instead of your household, and also the death advantage decreases with time as you make mortgage payments, comparable to a decreasing term life insurance plan. Purchasing a conventional term plan rather is a far better choice. Best for: Anyone with mortgage commitments who's not qualified for traditional life insurance coverage.Disadvantage: Limited insurance coverage it only shields mortgage payments. Credit report life insurance policy is a kind of life insurance policy plan that pays to a lender if you pass away prior to a financing is settled as opposed to paying to your recipients. The policy is connected to a single debt, such as a mortgage or service funding.

You're guaranteed authorization and also, as you pay for your finance, the survivor benefit of your policy reduces. Health Insurance in Toccoa, GA. If you die while the plan is in pressure, your insurance policy carrier pays the survivor benefit to your lending institution. Home loan security insurance coverage (MPI) is one of one of the most common kinds of debt life insurance policy.

Report this wiki page